In a data-driven era, our client, a premier European bank, initiated a transformative journey into Generative AI. With a mission to demystify this hype, we designed a tailored workshop to tackle the complexities of Generative AI and Large Language Models (LLMs) for an audience that included both technical and business experts.

This case study explores that journey, from initial theoretical immersion to strategic achievements, highlighting our role in sparking a new era of strategic innovation in banking. At the center is the pilot project that emerged from the workshop – an initiative that will not only increase the use of LLMs within the bank, but also support broader adoption of Generative AI. This evolution – from workshop to pilot and beyond – sets a path for embedding Generative AI at the core of the bank’s innovation strategy, providing a blueprint for internal expansion and technology adoption.

Context & Challenges

In the swiftly changing financial landscape, staying at the forefront of the latest technological advancements is crucial for a competitive edge. Our client, a leading bank operating in Europe, has always been at the forefront of adopting innovative solutions to enhance its services and operational efficiency. With a strong foundation in AI fields such as Machine Learning (ML) and Natural Language Processing (NLP), the bank has collaborated with us on several successful projects in the past.

As in many industries, the concept of Generative AI and LLMs started gaining traction for its potential to revolutionize various facets of the banking and financial services industry. Given our longstanding partnership and shared vision for innovation, our client approached us to conduct a comprehensive workshop on Generative AI.

The workshop aimed to demystify Generative AI’s principles through theory and practice, enriched by code examples for hands-on experience. The bank envisioned this workshop as an initial step to evaluate the potential implications and applications of this emerging technology in their operations. Several key challenges were outlined by our client as the core focus of the workshop:

- Broader Impact Assessment: Understanding the overarching impact of Generative AI on the bank’s operations, the financial industry in general, and the broader economy was crucial. This involved evaluating whether it was the right time to embrace Generative AI or if waiting for the technology to mature further was a more prudent approach.

- On-Premise Feasibility: A significant concern revolved around the feasibility of implementing Generative AI solutions within an on-premise infrastructure. The focus was obviously on ensuring robust data security and adherence to regulatory standards due to the sensitive nature of financial data.

- Technical Intricacies: Delving into the technical intricacies of implementing Generative AI, including the selection of suitable tools and the necessary infrastructure, was a key area of exploration. The workshop needed to provide a clear roadmap for navigating through the implementation of Generative AI.

Our Approach: A Generative AI Workshop for Banking

To address the multifaceted challenges posed by our client, we meticulously designed a workshop for exploring Generative AI. Our approach was custom-designed for both technical and business audiences, ensuring a comprehensive understanding of Generative AI’s potential. It was structured into several key segments, each aiming at covering different aspects of Generative AI and LLMs:

Diverse Audience Engagement

Acknowledging the varied expertise and interests of the attendees, the workshop was designed to cater to a broad audience. The segments were carefully crafted to ensure that both the business and technical teams found the discussions enriching and directly relevant to their respective domains and perspectives.

Theoretical Exposure

The theoretical segments of the workshop served as the basis for building a solid understanding of Generative AI. We delved into its impact on business operations, the financial industry, and the economy at large. This section also covered essential tooling, cost implications, and various conceptual frameworks that underpin Generative AI, laying a robust foundation for the practical sessions that followed.

Practical Engagement

Transitioning from theoretical discussions to practical engagements, we orchestrated sessions focusing on prompting and implementing NLP solutions with LLMs. Participants were given the opportunity to engage in hands-on coding exercises or review the code examples we had prepared, thus getting a firsthand experience of implementing such advanced solutions.

Industry-Specific Insights

Incorporating industry-specific insights was crucial to make the discussions highly relevant and engaging. Drawing parallels from the banking sector, we presented statistics and use cases that resonated with the client’s domain, thereby facilitating a deeper comprehension of Generative AI’s applicability in the banking industry.

Project-Centric Discussion

An integral part of the workshop was dedicated to exploring how Generative AI could dovetail into ongoing and prospective projects. Engaging in an in-depth discussion, we collaboratively identified, prioritized, and challenged potential new use cases. This segment aimed at gauging the practicality and the value addition that Generative AI could bring to the table, in real-world project scenarios.

Our approach was calibrated to not only impart knowledge but also to stimulate thought-provoking discussions, enabling the participants to envision (all) the possibilities that Generative AI could unfold in the banking sector.

Key Benefits and Generative AI Applications

The meticulously designed workshop yielded substantial benefits, helping our client to gain a clear perspective on the potential of Generative AI. Here are the key advantages we observed:

Informed Decision-Making:

The deep insights raised from the workshop empowered our client to make well-informed decisions regarding their infrastructure and project strategies. The comprehensive understanding of Generative AI’s implications provided a solid basis for evaluating its relevance and applicability in their operational landscape.

Methodology Reassessment:

One of the tangible outcomes of the workshop was the reassessment of methodologies employed in an ongoing KYC (Know Your Customer) check automation project. Together, we revisited the project strategies, and the newfound understanding of Generative AI triggered a shift in methods to enhance the project’s efficiency and effectiveness.

New Project Initiation:

The workshop also marked the inception of a new project focused on transforming unstructured data into structured data, a crucial undertaking in the banking sector. This brand-new project demonstrated the practical application of the knowledge acquired during the workshop, embodying the client’s confidence in the potential of Generative AI and LLMs.

Enhanced Technical Acumen:

The hands-on sessions and practical engagements during the workshop significantly reinforced the technical acumen of the participants. The opportunity to work on code and explore real-world examples enriched their understanding, preparing them for the technical challenges that lay ahead in implementing such advanced solutions.

Strategic Direction:

The workshop played a pivotal role in shaping the strategic direction of our client. By identifying and prioritizing new use cases, they were better positioned to align their strategies with the evolving technological landscape, thereby fostering a culture of continuous innovation and readiness to embrace emerging technologies.

The benefits derived from the workshop are a testament to the pragmatic and collaborative approach adopted, which not only facilitated a robust understanding of Generative AI but also catalyzed actionable steps towards its adoption.

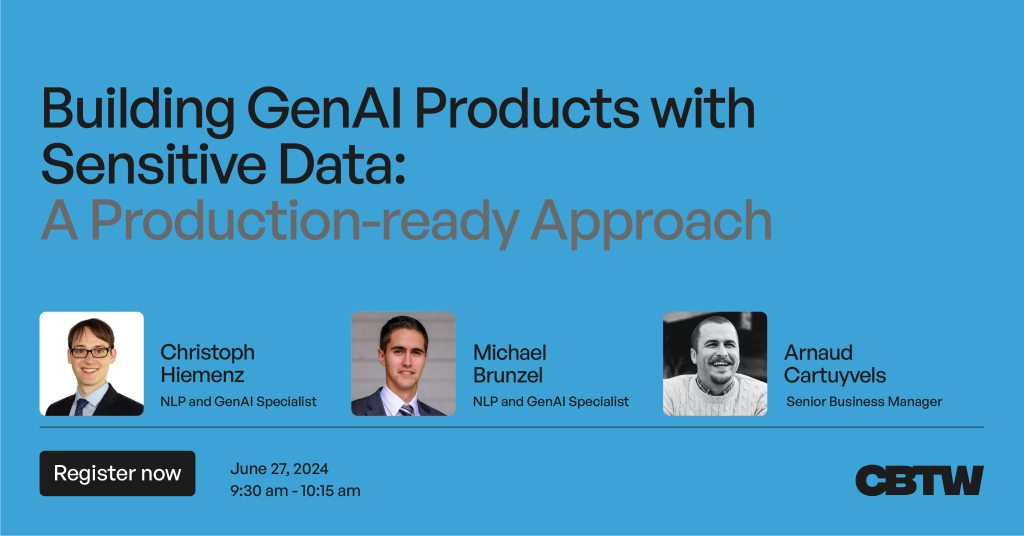

Team Involved During this Generative AI Workshop

For this workshop to be effective and insightful, it was imperative to have a team with a profound understanding of both the theoretical and practical aspects of Generative AI. We therefore deployed a team of two NLP experts for a month to prepare and execute the workshop, and provide the necessary to our client.

The NLP experts brought a wealth of experience to the table. Their comprehensive understanding of Generative AI, coupled with their ability to elucidate complex concepts in a digestible manner, made them the ideal facilitators for this workshop. They were adept at tailoring the content to cater to both the business and technical audiences, ensuring a holistic understanding of the topics discussed.

In the follow-up project concerning the transformation of unstructured to structured data, one NLP expert was assigned to work alongside the client’s team for at least four months. This engagement facilitated a collaborative and effective environment, ensuring the successful implementation of the solution proposed during the workshop.

Technologies Used

The technical backbone of this Generative AI workshop in Banking and the subsequent projects was supported by a suite of cutting-edge technologies:

- Python: Being a versatile and widely-used programming language, Python was the primary language used for coding and implementing the solutions discussed during the workshop.

- HuggingFace: This technology was leveraged for its robust NLP libraries, enabling the efficient implementation of Generative AI solutions.

- Azure: Microsoft Azure provided the cloud infrastructure necessary for hosting and managing the AI models discussed during the workshop.

- Databricks: Utilized for its big data analytics capabilities, Databricks facilitated the handling and analysis of large datasets, a common requirement in Generative AI projects.

- Langchain: This technology was employed for its language processing capabilities, crucial for the NLP aspects of the workshop and projects.

- Llama Index: Leveraged for indexing and searching capabilities, aiding in managing unstructured data effectively.

- Haystack: This technology was employed for its search and indexing capabilities, streamlining the handling of vast amounts of data.